pay indiana state property taxes online

Property. Agriculture Indiana State Department of.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Property Tax Payments - Search.

. Main Street Crown Point IN 46307 Phone. Please contact your county Treasurers office. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65.

Please contact the Indiana Department of Revenue at 317 232-1497. In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. The treasurer settles with township and city treasurers for taxes collected for the county and state.

ONLINE BANKING or PHONE Pay by creditdebit card or e-check at wwwbartholomewingov paperless billing. Beginning July 7 2022 no new registrations will be accepted via INtax. E-checks will incur a convenience fee of 150 per transaction.

Create an INtax Account. If your Property is up for Tax Sale making payment online WILL NOT remove it from the sale. This tax bill is the Only Notice you will receive for payments of BOTH INSTALLMENTS of your taxes.

Pay Property Tax Online. Please direct all questions and form requests to the above agency. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction.

183335552227774003 Numbers Only Please use only 1 Search Option at a time. It looks like something has gone wrong. Please put the address of your tax payment in the box provided.

Use First Name Last Name Example. A convenience fee will be assessed 6. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax accounts in one convenient location at intimedoringov.

Credit and debit card transactions will incur a convenience fee of 235 of your total tax liability. 100 W Main St OR. You need to come in the office and bring cash or certified funds.

PAY TAXES ONLINE at wwwpaygovus NOTE. Update Tax Billing Mailing Address. When prompted provide your taxpayer identification number or Social Security number and your liability number or warrant number.

Make sure you are paying for local payments Enter our location information Indiana Vanderburgh County Follow the directions online Disclaimer. Call 855-423-9335 with questions. The Indiana Department of Revenue DOR is in the process of moving to its new online e-services portal INTIME which will soon offer all customers the ability to manage tax accounts in one convenient location 247.

The state Treasurer does not manage property tax. Community. You should also know the amount due.

If you are interested in paying your property taxes via an online-bill-pay you will need to contact your financial institution to inquire if they offer this service. To pay online visit eNotices Online or to pay by phone call 877-690-3729 and use Jurisdiction Code 2413. Use 18 Digit Parcel Number Example.

Center 220 N Main St Kokomo IN 46901 Open Monday-Friday from 8am-4pm. Chemist. This service only accepts one-time full or partial payments made with ACHeCheck and Credit Card.

Pay my tax bill in installments. After selling to a corporation buyers in Indiana get a year after the sale to pay redemption expenses and repossess their homes. You can pay your property tax over the phone by calling 317327.

Only authorized banks can accept on-time payments. Pay your full property tax bill via a participating bank. But dont worry were working to get it back on track.

Use Address Example. How Long Can You Go Without Paying Property Taxes In Indiana. La Porte County Government accepts online payments for Traffic Tickets Probation Fees Property Taxes and more.

Call 855-423-9335 with questions. This search may take over three 3 minutes. Find Indiana tax forms.

Have more time to file my taxes and I think I will owe the Department. How Do I Pay My Indiana Property Taxes. If your Property is up for Tax Sale making payment online WILL NOT remove it.

Animal Health Board of. File Homestead and Mortgage Deductions Online. The County Treasurer is the property tax collector and custodian of all monies with responsibility for investing idle funds and maintaining an adequate cash flow.

Building A 2nd Floor 2293 N. In addition eCheck payments are accepted online for a flat fee of 150 with ATM Verify Verification Services. Convenience fees are collected by the processing company not Vigo County.

INtax only remains available to file and pay the following tax obligations until July 8 2022. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account s in one convenient location 247. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Claim a gambling loss on my Indiana return. Take the renters deduction. Pay Property Taxes Online.

Emergency Alerts and Public Notices System. The transaction fee is 25 of the total balance due. 4TAX 4829 or 1888 You can pay your property tax by mail.

The treasurer collects real personal and mobile home. A 250 150 minimum processing fee is charged for creditdebit card payments and a 395 fee is charged for Visa and MasterCard Debit Tax Programs. If you have an account or would like to create one or if you would like to pay with Google Pay PayPal or PayPalCredit Click Here.

Pay Your Property Taxes. Know when I will receive my tax refund. 6-1 on the file.

E-Check Visa Mastercard Discover and American Express accepted. FirstNameJohn and LastName Doe OR. Physical Address View Map.

This includes making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service. Transaction Fees are Non-Refundable. Pay online using MasterCard Visa or Discover at the Indiana state government ePay website see Resources.

General Contact Info Howard County Admin. VISA Debit 395 All other plastic 260 of total tax.

About The Local Tax Finance Dashboard Gateway

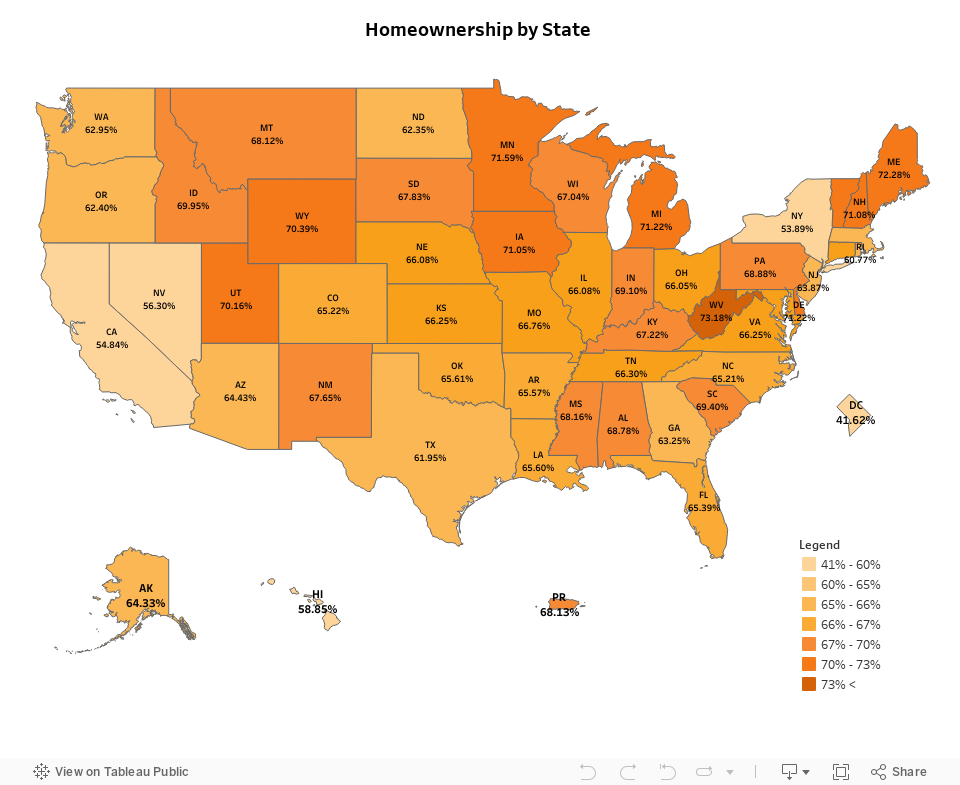

Property Taxes By State Propertyshark

Property Taxes By State Embrace Higher Property Taxes

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

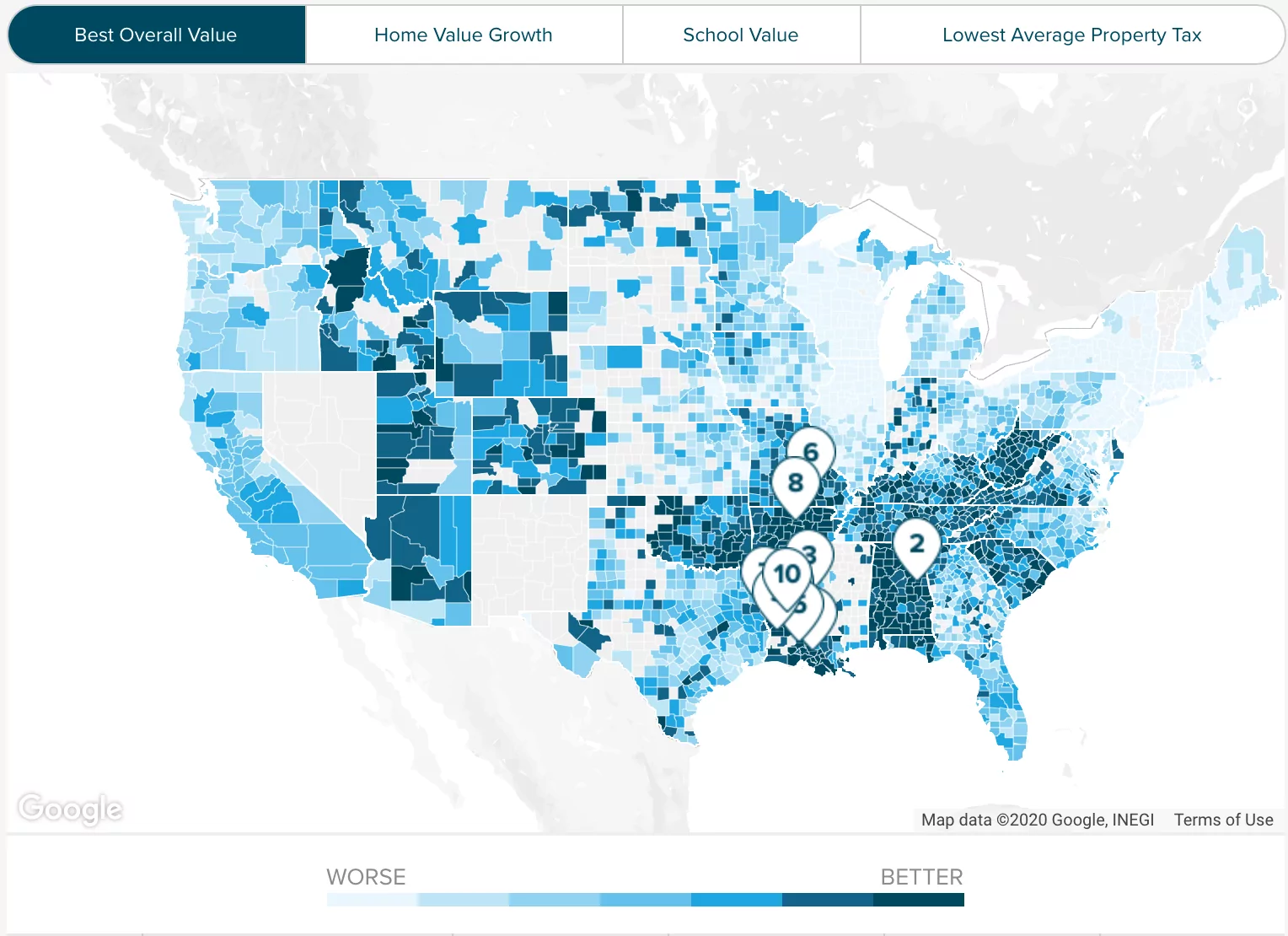

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Indiana Sales Tax Small Business Guide Truic

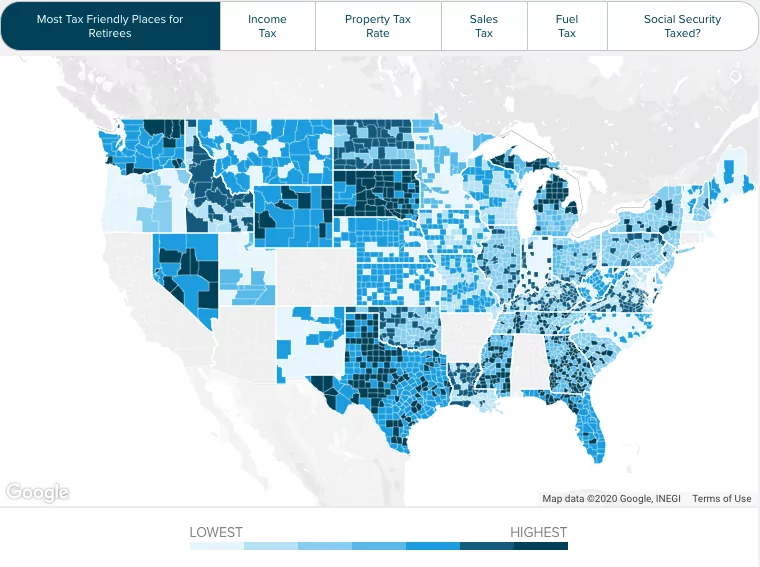

Indiana Retirement Tax Friendliness Smartasset

About The Local Tax Finance Dashboard Gateway

Delaware Property Tax Calculator Smartasset

Where S My State Refund Track Your Refund In Every State Taxact Blog

Orange County Ca Property Tax Calculator Smartasset

Blog Us Tax Lien Association Types Of Taxes Us Tax Exit Strategy

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione